HMRC statistics reveal UK companies benefitted by £5.3bn from Government’s R&D Tax Credit Initiative

New statistics published by HMRC today reveal that a total of £5.3 billion was paid out to UK businesses in research and development (R&D) Tax Credits, up from £4.3 billion according to statistics released this time last year.

The total number of claims stands at 59,265, with the overwhelming majority, 52,160, coming from small to medium-sized businesses.

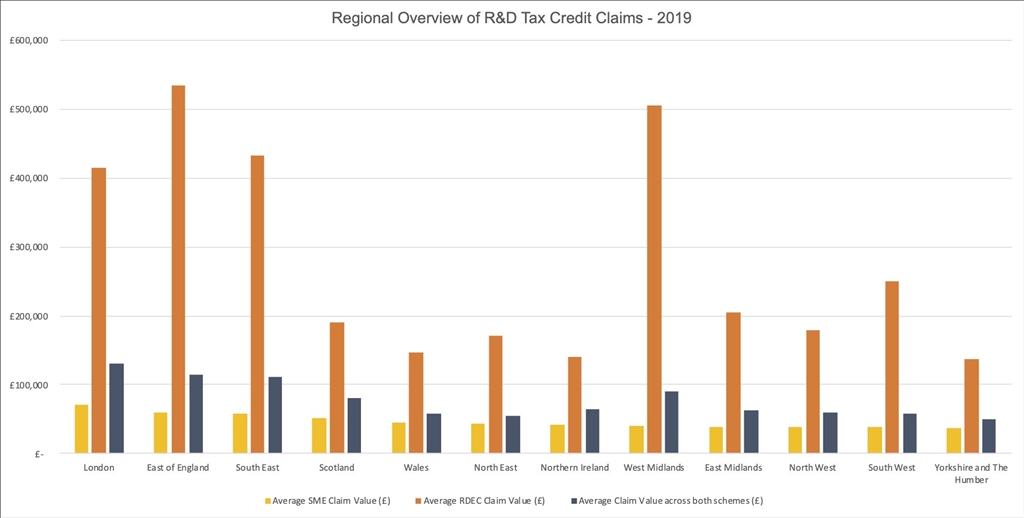

The statistics also show that London retains the top spot with Northern Ireland still one of lowest regions for claims.

Designed to drive innovation, the average received per R&D tax claim by companies in Northern Ireland was £65,015, compared to those in London benefitting from the highest average claim of £129,865.

Regional overview of R&D Tax Credit Claims - 2019

The figures were released as we launch our ‘Rebound’ support service which aims to assist businesses by maximising their uptake of all available grants and R&D tax benefits offered by the UK government.

Commenting on the latest statistics, Tom Verner, MD of The Momentum Group said; “It is encouraging to once again see a rise in the number of R&D Tax Credit claims.

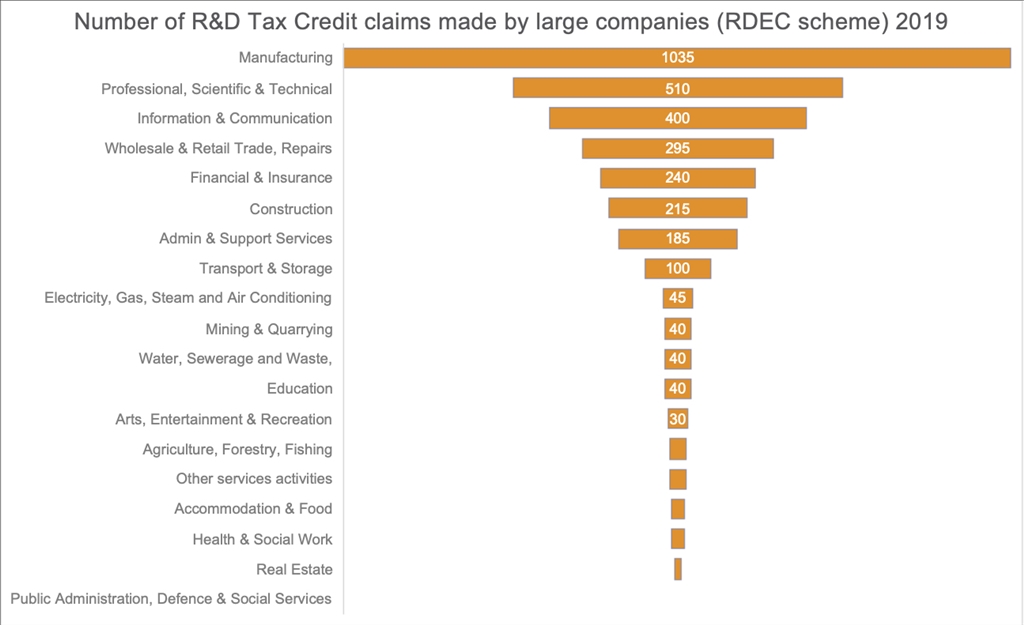

“The ‘Manufacturing’, ‘Professional, Scientific and Technical’, and ‘Information and Communication’ sectors continued to have the greatest volume of claims, making up a total of 66% and 71% of the total monetary amount claimed for 2018-19. Interestingly it also shows that younger companies from 0-10 years old account for 46% of all claims, reflecting that start-ups and entrepreneurial companies may have greater awareness of R&D Tax Credits than their more established counterparts.

“Whilst this is a welcome trend, we believe there are still a great many innovative companies missing out on potentially tens of thousands of pounds in R&D Tax Credits.

“The launch of our Rebound support service comes in response to the dual challenge for businesses operating under the looming threat of a no-trade deal Brexit and an ongoing global pandemic. We are all in this together and at Momentum we have been offering, and will continue to offer, free claims advice to companies during these pressured times.

“We believe in the ‘bouncebackability’ of businesses across the UK. That word was first coined by Crystal Palace manager, Iain Dowie when describing how his team went from the fringes of relegation to being promoted and I am confident Momentum can help businesses look to a brighter future after the unparalleled difficulties of 2020.”

To further underline the commitment to research and development support, at the last budget Chancellor, Rishi Sunak pledged to increase spending on overall R&D to £22billion per year by 2024-25.

Mr Verner said; “Between the £38billion spent by the Government on Bounce Back loans for businesses affected by the Covid pandemic, and the potential tax relief that can be claimed in R&D, there is so much support for businesses out there but awareness and understanding of the latter remains stubbornly poor.”

“But often in uncertain times, businesses are driven to be more innovative and this work can qualify for R&D Tax Credits. 2020 has been an incredibly difficult year for business with Covid-19 generating great uncertainty and it is likely the monetary value of claims will be lower in the next period due to issues such as staff being on furlough. However, in our view, it is vital that companies thoroughly examine their R&D activities now to ensure all opportunities for support are explored.”

“For example, a number of companies joined the fight against Covid-19 by switching production to make medical items, PPE and hand sanitiser. This work will have required a degree of R&D and it is right these companies receive the financial support they are entitled to.

“In addition, the government has committed to processing claims within 28 days, meaning successful claims could have an immediate positive impact on balance sheets at a time when cash flow is critical.

“Momentum can help, we recognise that businesses will know their own sectors inside out but often struggle when it comes to understanding what qualifies for R&D Tax Credit claims.

“Our Rebound support service aims to work directly with companies to conduct strategic reviews of their business before putting strategies in place to identify wide-ranging R&D and innovation opportunities.”